Changes in Health Care Use and Costs After a Break in Medicaid Coverage Among Persons With Depression

Medicaid serves as the primary source of health insurance for millions of poor and medically indigent Americans ( 1 ). Studies have shown that access to and utilization of health services improve significantly upon enrollment in Medicaid ( 2 , 3 ). Thus, once an individual enrolls in Medicaid, a common assumption is that access to care is no longer a problem. Although noncontinuous Medicaid coverage is common ( 4 ), little is known about the effect of interruptions in coverage on utilization of and expenditures for Medicaid-reimbursed services. The causes of interruptions in Medicaid coverage for beneficiaries with depression are not well understood, but much has been written about the complex enrollment and reenrollment procedures associated with Medicaid and the State Children's Health Insurance Program, which make coverage difficult to maintain over time for all beneficiaries ( 5 , 6 ).

A study of the termination of Medicaid benefits in California demonstrated a significant drop in access to and utilization of health services as well as worse health status after Medicaid eligibility was discontinued ( 7 , 8 ). In addition, other studies have generally found that compared with people who have health insurance, those without coverage have lower rates of preventive service use ( 9 , 10 , 11 ), have greater problems paying medical bills ( 12 , 13 ), lack a usual source of care ( 14 ), and report no physician visits over a period of time ( 14 ).

Given these previous findings, it is reasonable to presume that when most individuals lose their Medicaid coverage, they stop consuming health services. For some individuals, especially those with chronic conditions, health status may deteriorate to the point where acute care is needed. One of the only studies to look at the effect of interruptions in Medicaid coverage found that individuals with a diagnosis of schizophrenia who experienced interruptions in their coverage used significantly more inpatient psychiatric services than individuals who had continuous Medicaid coverage ( 15 ). That study compared utilization by individuals with interruptions in coverage and those with continuous coverage but did not distinguish whether utilization of inpatient services occurred before or after interruptions in coverage.

As with individuals with a diagnosis of schizophrenia, individuals with a diagnosis of depression are likely to be vulnerable during periods of lapsed Medicaid coverage. According to depression care guidelines, individuals with depression should receive both acute and maintenance treatment for their condition ( 16 ). It is unlikely that individuals with lapsed coverage will be able to continue receiving maintenance treatment, increasing the probability that they will have an episode of acute depression, possibly necessitating acute care services, such as a visit to an emergency department or inpatient treatment.

This study expanded on the study by Harman and colleagues ( 15 ) by examining individual changes in utilization and expenditures that occur after an interruption in Medicaid coverage among beneficiaries with depression. We used Medicaid claims and eligibility data from Florida for the period of 1999 through 2002 to assess the association of interruptions in Medicaid coverage with utilization of Medicaid-reimbursed emergency department visits, inpatient admissions, and total Medicaid expenditures. This study also assessed how enrollee characteristics are associated with the magnitude and direction of the change in utilization and expenditures after an interruption in coverage. We obtained institutional review board approval to conduct this study.

Methods

Data

We analyzed claims and eligibility data from January 1999 to December 2002 from Florida Medicaid for adults with diagnosed depression. Medicaid claims provide reasonably accurate measures of service utilization when providers are paid on a fee-for-service basis ( 17 , 18 , 19 ). Because beneficiaries over the age of 64 would likely have dual Medicare coverage, these individuals were excluded from the analysis.

Beneficiaries with depression were identified on the basis of diagnoses assigned by providers during health care encounters and recorded on claims in 1999. Using ICD-9 codes, we identified all individuals with claims indicating a primary diagnosis of major depression, single episode (296.2x); major depression, recurrent episode (296.3x); and dysthymia (300.4). The selection process identified 33,060 nonelderly adults diagnosed as having depression. The sample admittedly excluded individuals who did not receive treatment during the study period, had depression but did not have a recorded diagnosis, or who became initially eligible for benefits after December 1999. However, the study accurately showed changes in Medicaid-reimbursed services and expenditures for individuals identified by their physicians as having depression and who were in active treatment.

Individuals diagnosed as having depression were then identified as having an interruption in Medicaid coverage if they experienced 32 or more consecutive days without Medicaid coverage. This period of disenrollment was chosen because Medicaid beneficiaries in Florida with a gap of one month or less can be retroactively enrolled for that one-month period. Thus they can be enrolled in Medicaid but may not appear in the eligibility files for that period. Periods of disenrollment that were open ended and continued to the end of the study period were not identified as interruptions because claims data would not be available for the subsequent period of reenrollment. A total of 2,909 (9%) of individuals identified as having depression experienced at least one interruption in coverage. The period of interrupted coverage ranged from 32 to 1,219 days, with a mean of 278±241 days and a median of 284 days. Characteristics of individuals with and without Medicaid interruptions are presented in Table 1 .

|

We further limited the primary analysis to individuals who experienced a single interruption in coverage during the study period and had three full months of eligibility both before and after the interruption. We excluded individuals with multiple interruptions because there was no clear way to categorize periods of eligibility that took place between two interruptions. Most individuals who experienced an interruption in coverage experienced only a single interruption. The final sample consisted of data for 1,946 individuals. Compared with individuals with multiple interruptions in coverage ( Table 1 ), individuals with a single interruption were slightly older, more likely to be male, less likely to be Latino, more likely to have a disability, and less likely to have switched eligibility categories.

Analytic approach

The basic analytic approach was to use each beneficiary as his or her own control for the analysis by using as the dependent variable the change in that individual's utilization or expenditures between the three-month periods immediately before and after an interruption in coverage. A three-month period was chosen so that the analysis would not be overly sensitive to events that occurred in the days immediately before or after an interruption in coverage. To ensure that the three-month period before an interruption was representative of baseline utilization, we compared utilization in the three months immediately before an interruption with utilization in the fourth through sixth months preceding the interruption. Utilization was the same in both periods for 99% of the sample, and a Wilcoxon signed-rank test showed no difference in total expenditures between the two periods, suggesting that the three-month period served as an adequate baseline measure.

In order to better understand which Medicaid beneficiaries were more likely to experience greater utilization or expenditures after an interruption in coverage, we performed multivariate analyses. We examined both mean change in utilization and expenditures and the probability of having greater expenditures during the three-month period after an interruption in coverage.

Variables

Dependent variables. Three dependent variables were used in the analysis: change in total inpatient admissions, change in total number of emergency department visits, and change in total expenditures. All inpatient admissions were included regardless of length of stay (for example, a 23-hour visit counted as admission). Emergency visits were identified with a flag in the claims data. Emergency visits that resulted in inpatient admissions were counted as inpatient admissions and not as emergency visits. Total expenditure amounts were calculated from the dollar amounts that Medicaid paid to providers for services as indicated in the claims data and pharmacy claims. Total expenditures were the sum of the facility, physician, and pharmacy expenses. Expenditures were adjusted to 2002 dollars according to the Medical Care Consumer Price Index.

Interruptions in Medicaid coverage. A continuous variable was created that corresponded to the number of months of interrupted Medicaid coverage. The purpose of the length-of-interruption variable was to determine whether the difference in utilization or expenditures was related to the length of time without Medicaid coverage. To account for a potential nonlinear relationship of interruption length and utilization and expenditures, three lengths of interruption categories were created: one to two months, three to six months, and more than six months. Admittedly, the cutoff points for this categorization were somewhat arbitrary but corresponded to short, moderate, and long interruptions.

Demographic variables. A secondary goal of the analysis was to assess whether particular patient characteristics were associated with the magnitude of the change in utilization or expenditures after an interruption in coverage. The patient characteristics examined included age, gender, race, ethnicity, living in an urban versus a rural setting, as well as a proxy measure of health status and severity of illness, which was a variable corresponding to whether the individual qualified for Medicaid through a disability at baseline. A variable indicating whether the enrollee switched eligibility category after the lapse in coverage also was included.

Statistical analyses

First, the difference in inpatient admissions, emergency visits, and expenditures was calculated. Paired t tests were performed to assess whether the mean difference was significantly different from zero. In addition, in order to decrease the influence of outliers, nonparametric Wilcoxon signed-rank tests were performed to assess whether the changes in utilization or expenditures were significantly different from zero ( 20 ).

Next, two sets of multivariate analyses were performed to assess whether patient characteristics as well as the length of the interruption were associated with the mean difference in expenditures and utilization and with the probability of experiencing greater expenditures and utilization. Least-squares regressions were performed on the change variables to assess which characteristics were significantly associated with mean change measures. For the analysis of expenditures, a square root transformation was used because of the skewed distribution. Logistic regressions were performed to assess which patient characteristics were significantly associated with the probability of experiencing an increase in utilization or expenditures after an interruption in coverage. For visits to the emergency department, a secondary analysis to assess differences in time between visits was assessed. We conducted all analyses with STATA statistical software, and we used the Huber-White sandwich estimator to obtain robust standard errors for multivariate analyses ( 21 , 22 ).

Results

Inpatient episodes

The probability of any hospitalization and the mean number of hospitalizations during the preinterruption period and the postinterruption period are presented in Table 2 . Both the probability of being hospitalized (t=3.91, df=1,945, p<.001) and the mean number of hospitalizations significantly increased after the interruption in coverage (t=4.41, df=1,945, p<.001), with the significant difference in the mean number of hospitalizations holding when compared by using a Wilcoxon signed-rank test (z=4.44, df=1,945, p<.001). A total of 126 beneficiaries had more hospitalizations during the postinterruption period, 65 had fewer hospitalizations, and 1,755 had no difference in hospitalizations.

|

Multivariate analysis ( Table 3 ) showed that switching eligibility category was the only characteristic associated with the mean difference in the number of hospitalizations, with switching associated with a smaller change in hospitalizations (t=-2.46, df=1,936, p=.014). None of the characteristics examined were significantly associated with the probability of greater inpatient episodes, although no beneficiaries who experienced an interruption of less than two months experienced an increase in hospitalizations.

|

Emergency department visits

The probability and mean number of emergency department visits in the preinterruption and postinterruption periods are presented in Table 2 . There was more than a 170-fold increase in the number of emergency visits (t=13.89, df=1,945, p<.001), and this significant difference held when using a Wilcoxon signed-rank test (z=16.9, df=1,945, p<.001). A total of 292 individuals (15%) experienced an increase in emergency visits during the postinterruption period, one beneficiary experienced a decrease in emergency visits during the postinterruption period, and 1,653 beneficiaries (85%) had no change. When time between emergency visits was compared between individuals with interrupted coverage and those with continuous coverage, individuals with interrupted coverage visited the emergency department every 170 days, whereas those with continuous coverage visited every 206 days (z=3.34, df=1,695, p=.001).

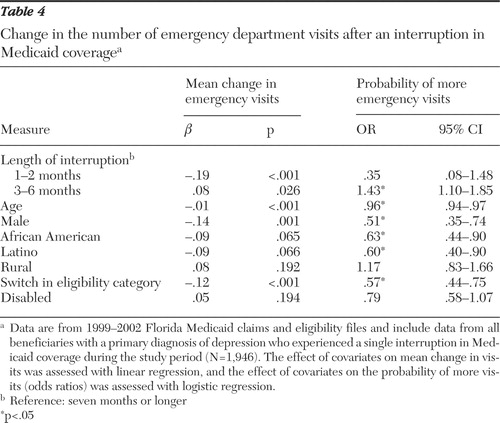

Younger adults (t=-7.65, df=1,936, p<.001) and women (t=-3.45, df=1,936, p<.001) had greater mean changes in emergency department visits ( Table 4 ). Compared with individuals with interruptions of seven months or longer, individuals who had interruptions of one to two months had significantly fewer emergency visits (t=-4.15, df=1,936, p<.001) and those with interruptions of three to six months had significantly more emergency visits (t=2.22, df=1,936, p=.026). A switch in eligibility category was negatively associated with a mean change in the number of emergency visits (t=-3.56, df=1,936, p<.001). When the probability of an increase in emergency visits was examined, older age (z=-6.71, df=1,936, p<.001), male gender (z=-3.50, df=1,936, p<.001), African-American race (z=-2.55, df=1,936, p=.011), and switched eligibility (z=-4.09, df=1,936, p<.001) were associated with a lower probability of an increase in emergency visits after an interruption in coverage, whereas interruptions of three to six months (z=2.70, df=1,936, p=.007) were associated with a greater probability of an increase in emergency visits.

|

Total Medicaid expenditures

Mean total expenditures during the preinterruption and postinterruption period are presented in Table 2 . There was a $377 increase in mean expenditures after an interruption in coverage (t=4.05, df=1,945, p<.001), and this difference held with a Wilcoxon signed-rank test (z=3.33, df=1,945, p<.001). A total of 964 individuals (50%) had greater expenditures during the postinterruption period, 917 (47%) had lower expenditures, and 65 (3%) had no change in expenditures.

The mean change in expenditures ( Table 5 ) was significantly less for older beneficiaries (t=-4.02, df=1,936, p<.001), men (t=-2.44, df=1.936, p=.015), African-American beneficiaries (t=-2.13, df=1,936, p=.033), and beneficiaries who switched eligibility categories (t=-5.62, df=1,936, p<.001) between the preinterruption and postinterruption eligibility spans. Beneficiaries with interruptions lasting three to six months had significantly greater increases in expenditures than individuals with interruptions lasting seven months or longer. Consistent with these results, younger age (z=-5.01, df=1,936, p<.001) and female gender (z=-3.83, df=1,936, p<.001) were associated with a greater probability of an increase in expenditures when returning to Medicaid. Individuals with interruptions lasting three to six months had 47% greater odds (z=4.08, df=1,936, p<.001) of an increase in expenditures. Switching eligibility categories was associated with a lower probability of experiencing an increase in expenditures. In addition, the odds of greater expenditures were 28% greater for beneficiaries who were eligible for Medicaid through a disability than for those who were not (z=2.22, df=1,936, p=.026).

|

Discussion

The results of this study suggest that utilization of emergency and inpatient services as well as overall Medicaid expenditures significantly increase for a subset of beneficiaries with a diagnosis of depression when Medicaid coverage resumes after a temporary loss in coverage. These findings are consistent with the findings of a previous study that examined the effect of interruptions in Medicaid coverage on use of inpatient services by beneficiaries with diagnoses of schizophrenia ( 15 ). Therefore, two separate studies using two different populations (those with diagnoses of schizophrenia or depression) in two different Medicaid programs (in Utah and Florida) and two different methods of comparing utilization (continuous coverage as control or preinterruption period as control) found that there was an association of interruptions in Medicaid coverage with greater use of services. Emergency department use in particular increased after the interruption in coverage. This finding suggests that the emergency department serves as a major entry point for people returning to care. The emergency visit may have served as the catalyst for reenrollment in Medicaid, although this possibility was not directly tested.

Although there was a mean increase in service utilization and expenditures after an interruption in coverage, less than half of the beneficiaries experienced an increase in expenditures. Multivariate analyses demonstrated that younger enrollees, women, nonminorities, and individuals with disabilities had greater mean changes in emergency department utilization and total expenditures after an interruption and were more likely to experience increased expenditures. Policy makers could use this information to target policies for enrollees who are most likely to be adversely affected by interruptions in coverage.

Several limitations of the study should be noted. First, the study relied solely on Medicaid claims and eligibility files. Therefore, only Medicaid-reimbursed service utilization could be assessed. There is no way to know what types of services were used during the period without Medicaid coverage or whether other services that were not reimbursed by Medicaid were utilized. Therefore, we could not directly test the hypothesis that access to care, and subsequently, utilization, dropped during periods of interrupted coverage. However, previous studies have shown that most Medicaid beneficiaries who lose Medicaid coverage become uninsured and do not access care at the same rate as when they are insured ( 4 , 7 , 8 ). In addition, administrative data are often subject to inaccuracies in coding. Nevertheless, these kinds of data remain the best source of information on health care utilization in this population.

Another limitation is that this analysis demonstrated only that there was a mean increase in emergency department and inpatient utilization and Medicaid expenditures in the three months after a return to Medicaid relative to the period immediately before the period of lost coverage. No causal relationship between the interruption in coverage and the change in utilization and expenditures can be inferred. For example, the observed increase in emergency department utilization and overall expenditures could have occurred if individuals developed additional acute or chronic conditions during the period of interrupted coverage that were unrelated to reduced access to medical care. Because length of time of the interruption in coverage and enrollee age were both controlled for in the analysis, and would likely be highly correlated with the incidence of new medical conditions, this scenario is unlikely but still possible.

Conclusions

Although these limitations exist, this study provides evidence that there is a significant correlation between interruptions in Medicaid coverage and utilization and expenditures among beneficiaries with a diagnosis of depression. Specifically, significant increases in the utilization of inpatient and emergency services are experienced by enrollees when returning to Medicaid after an interruption in coverage, suggesting that some individuals may be reenrolled in Medicaid by providers when presenting for acute care services. The causes for the observed increased utilization of acute care services are not known. Given this increase, however, more research is needed on causes and consequences of interruptions in Medicaid coverage to aid policy makers in dealing with this important issue.

Acknowledgments and disclosures

The authors acknowledge support from the Florida Agency for Health Care Administration and grant K01-MH-63780 from the National Institute of Mental Health.

The authors report no competing interests.

1. Rowland D: Medicaid at 30: new challenges for the nation's health safety net. JAMA 274:271-273, 1995Google Scholar

2. Taube CA, Rupp A: The effect of Medicaid on access to ambulatory mental health care for the poor and near-poor under 65. Medical Care 24:677-686, 1986Google Scholar

3. Howell EM, Andrews RM, Gornick M: Longitudinal patterns of enrollment and expenditures for a Medicaid cohort. Health Care Financing Review 10:71-85, 1988Google Scholar

4. Short PF, Graefe DR, Schoen C: Churn, Churn, Churn: How Instability of Health Insurance Shapes America's Uninsured Problem. New York, Commonwealth Fund, 2003Google Scholar

5. Fairbrother G, Park HL, Haivderv A: Policies and Practices That Lead to Short Tenure in Medicaid Managed Care. Washington, DC, Center for Health Care Strategies, 2004Google Scholar

6. Ku L, Ross DC: Staying Covered: The Importance of Retaining Health Insurance for Low-Income Families. New York, Commonwealth Fund, 2002Google Scholar

7. Lurie N, Ward NB, Shapiro MF, et al: Termination from Medi-Cal—does it affect health? New England Journal of Medicine 311:480-484, 1984Google Scholar

8. Lurie N, Ward NB, Shapiro MF, et al: Termination of Medi-Cal benefits: a follow-up study one year later. New England Journal of Medicine 314:1266-1268, 1986Google Scholar

9. Broyles RW, Narine L, Brandt EN: The temporarily and chronically uninsured: does their use of primary care differ? Journal of Health Care for the Poor and Underserved 13:95-111, 2002Google Scholar

10. Bednarik HL, Schone BS: Variations in preventive service use among the insured and uninsured: does length of time without coverage matter? Journal of Health Care for the Poor and Underserved 14:403-419, 2003Google Scholar

11. Ayanian J, Weissman JS, Schneier EC, et al: Unmet health needs of uninsured adults in the United States. JAMA 285:410-411, 2001Google Scholar

12. Hoffman C, Schoen C, Rowland D, et al: Gaps in health coverage among working-age Americans and the consequences. Journal of Health Care for the Poor and Underserved 12:222-225, 2001Google Scholar

13. Schoen C, Des Roches C: Uninsured or unstably insured: the importance of continuous insurance coverage. Presented at the Association for Health Services Research annual meeting, Chicago, June 27-29, 1999Google Scholar

14. Kasper JD, Giovanni TA, Hoffman C: Gaining and losing health insurance: strengthening the evidence for effects on access to care and health outcomes. Medical Care Research and Review 57:298-318, 2000Google Scholar

15. Harman J, Manning WG, Lurie N, et al: Association of interruptions in Medicaid coverage and use of inpatient psychiatric services. Psychiatric Services 54:999-1005, 2003Google Scholar

16. American Psychiatric Association: Practice guideline for major depressive disorder in adults. American Journal of Psychiatry 150(Apr suppl):S1-S26, 1993Google Scholar

17. Lamont EB, Herndon JE, II, Weeks JC, et al: Criterion validity of Medicare chemotherapy claims in cancer and leukemia group B breast and lung cancer trial participants. Journal of the National Cancer Institute 97:1080-1083, 2005Google Scholar

18. Lurie N, Popkin M, Dysken M, et al: Accuracy of diagnoses of schizophrenia in Medicaid claims. Hospital and Community Psychiatry 43:69-71, 1992Google Scholar

19. McKenzie DA, Semradek J, McFarland BH, et al: The validity of Medicaid pharmacy claims for estimating drug use among elderly nursing home residents: the Oregon experience. Journal of Clinical Epidemiology 53:1248-1257, 2000Google Scholar

20. Berry DA, Lindgren BW: Statistics: Theory and Methods. Pacific Grove, Calif, Brooks Cole, 1990Google Scholar

21. STATA Statistical Software, release 7.0, special edition. College Station, Tex, Stata Corp, 2002Google Scholar

22. White H: Maximum likelihood estimation of misspecified models. Econometrica 50:1-25, 1982Google Scholar