Payeeship, Financial Leverage, and the Client-Provider Relationship

Assignment of a representative payee or money manager to a mental health care consumer is often used to mitigate poor financial decisions that result from having a mental illness or a substance use disorder. By guaranteeing the payment of consumers' basic living expenses and limiting the disbursement of discretionary funds, payee programs aim to promote responsible spending and discourage the purchase of alcohol or other drugs ( 1 , 2 , 3 , 4 ).

Although the evidence base is tentative, several studies suggest that payee programs offered within clinical settings confer secondary benefits in the form of reductions in hospitalization ( 3 ) and homelessness ( 5 ). Payeeship also has been linked to improved functioning in the areas of substance abuse, treatment adherence, and quality of life ( 1 , 6 , 7 ). Recent research, however, also highlights several potential downsides to payee arrangements.

Most notable, studies suggest that payeeship is sometimes associated with negative interactions between clients and payees ( 6 , 8 , 9 , 10 , 11 ); in particular, potential strain to the therapeutic alliance has been cited as a concern ( 1 , 6 , 10 ). Only one previous study, however, has directly assessed the effects of payeeship on the client-provider relationship ( 12 ). That study assessed whether clients assessed the alliance with their nonclinician payees as weaker than their alliances with their primary clinicians. No such differences were found, but because the sample studied was relatively small and did not include in the comparison clients without payees, clarification of this issue is needed.

Previous research implies that strain on the alliance stems from conflict between clients and payees over the payee's power to control money disbursement ( 6 , 10 , 11 ). Such tensions may be aggravated when payeeship is used strategically as a source of treatment leverage. That is, payees sometimes promote treatment adherence by making the receipt of funds contingent on appointment attendance, taking medication, or abstinence from drug or alcohol use ( 13 , 14 , 15 ). Thus payeeship could be viewed as an opportunity for the use of therapeutic social control or influence ( 16 ), or what has also been termed therapeutic limit setting ( 17 ). Although use of payeeship as leverage to promote treatment adherence is apparently somewhat common ( 13 , 14 ), recent studies show that this practice is associated with experiences of coercion and lowered autonomy ( 18 ) and that the practice is generally opposed by consumers ( 19 ).

In this study, we asked two questions. First, does having a clinician as a payee affect the case management relationship negatively? And second, if so, is the effect mediated by whether the payeeship arrangement is used as a source of financial leverage? The survey reported here assessed the prevalence of treatment pressures experienced by adults in public mental health services. To assess the effects of financial pressures on the treatment alliance, we used a recently developed measure of the client-provider relationship tailored specifically to the context of intensive service delivery to people with serious mental illness ( 20 ), which takes into account unique features of the case management relationship, including the potential for disagreement, conflict, and struggle ( 21 , 22 , 23 , 24 ), which may be particularly salient in the context of clinician payeeship.

Methods

Setting and data collection

Data used for this analysis came from one site of a multisite study designed to estimate the prevalence of various types of pressures to enter and adhere to treatment among a representative sample of mental health service users ( 13 ). The site studied here is a large urban community mental health center (CMHC) in which payee services (administration and disbursement of funds) are handled through a separate, nonclinical department that functions similarly to a banking environment. However, clinicians who performed case management duties had fiduciary authority, because they worked with consumers to develop budgets and make financial decisions. Hence, throughout this article we refer to payee services provided within the CMHC as "clinician payee" arrangements.

Research procedures were approved by the institutional review boards of the University of Chicago and of the CMHC that hosted the research. As described in a previous report ( 13 ), we identified and interviewed 205 consumer participants between May and December of 2003. Eligible participants had a primary axis I diagnosis. Of the 205 consumers, 99 (49%) had a diagnosis of schizophrenia, 34 (17%) had bipolar disorder, and 68 (33%) had a major depressive or anxiety disorder. All patients were between the ages of 18 and 65. All had received clinical services at the CMHC in the past month and provided informed consent before study entry.

Measures

Client-provider relationship. Respondents were asked to identify their CMHC case manager and to complete the Working Relationship Scales (WRS) ( 20 ) with reference to that clinician. The WRS, developed for use by clients with serious mental illness in case management settings, contains 50 items divided into positive (referred to here as "bond") and negative (referred to here as "conflict") subscales. The WRS subscales correlate highly (.80 for the bond subscale, -.70 for the conflict subscale) with the Working Alliance Inventory ( 25 ), a widely used measure of the therapeutic alliance (Angell B, Mahoney CA, unpublished manuscript, 2006). Because the WRS is a relatively new measure, we performed several psychometric tests to appraise its structure and reliability.

Confirmatory factor modeling procedures in LISREL 8.7 ( 26 ) were used to compare a one-factor model (all items loaded onto a single factor) with a two-factor model (bond and conflict). On the basis of a nested test for difference in model fit ( 27 ), the two-factor model best accounted for the observed covariances among the items (difference in χ2 =1,006.6, df=1, p<.001). The subscales were significantly correlated (r=-.56, p<.001), as are the subcomponents of most existing alliance measures ( 25 , 28 ). Reliability estimates of each component as calculated in the LISREL model were .97 for the bond subscale and .94 for the conflict subscale.

To obtain interval-level measures of the two components, we calibrated the items on the sample by using Rasch analysis with Winsteps software ( 29 , 30 ). After we omitted two poorly fitting items, the two scales showed good separation reliability (ability to separate subgroups of respondents, as assessed with Winsteps) of .92 and .81 for the bond and conflict subscales, respectively.

Money management and financial leverage. Money management characteristics were measured on the basis of client self-report. Respondents were asked whether a representative payee or someone else managed their money during the past six months and to indicate the nature of their relationship with the payee. Responses were classified by type of payee (no payee, noninstitutional payee, or clinician payee).

Perception of financial leverage was measured as a composite of responses to two series of questions presented in separate sections of the 1.5-hour interview. First, respondents who reported having a payee were asked whether the payee had ever withheld money until the respondent followed through on mental health treatment, alcohol or drug treatment, or taking medication. Respondents who answered affirmatively were coded as experiencing perceived financial leverage. Second, in a later section of the interview all respondents were asked whether, in the past six months, anyone had made them feel as though they would not receive spending money if they did not attend treatment appointments or take medications. If responses were affirmative, they were also coded as indicating financial leverage.

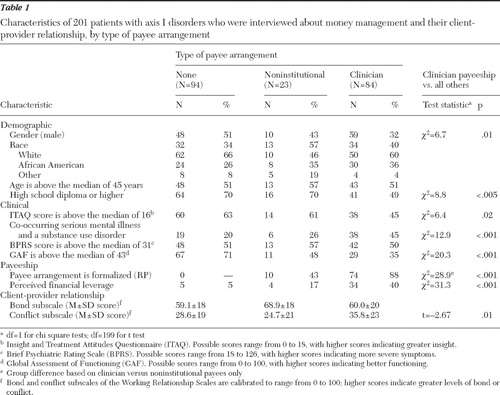

Demographic and clinical characteristics. Because treatment pressures and the client-provider relationship may be jointly influenced by characteristics such as the severity of the client's illness, functioning level, and treatment attitudes, we considered several such potentially confounding factors in the analyses. Demographic information (age, race, gender, and education level), shown in Table 1 , was gathered in the interview, and diagnostic information was obtained from clinical charts. Because co-occurring serious mental illness and substance abuse or dependence is a common criterion for payee assignment ( 31 ), we coded the presence of co-occurring disorders (schizophrenia spectrum disorders, bipolar disorder, or psychosis not otherwise specified plus a substance use disorder). The 18-item version of the Brief Psychiatric Rating Scale ( 32 ) and the Global Assessment of Functioning scale ( 33 ) were administered by trained interviewers, who were required to demonstrate ratings that achieved at least 80% agreement with the ratings of an experienced psychiatrist. Respondents also completed the Insight and Treatment Attitudes Questionnaire ( 34 ), which measures whether respondents believe that they have a mental disorder and require treatment. In these analyses we summed nine of the original 11 items of this questionnaire to improve internal consistency in our sample (Cronbach's α =.77). To compensate for skewed distributions and to facilitate comparisons with similar analyses from the larger study from which our sample was derived ( 13 , 18 ), we dichotomized continuously measured demographic and clinical characteristics at the sample median.

|

Statistical analysis

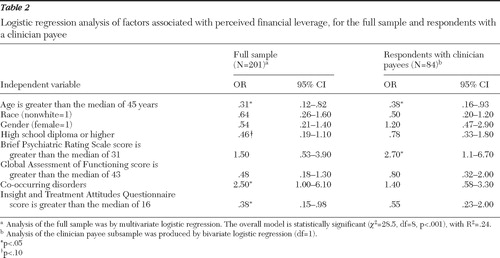

Complete data were available for 201 respondents. First, individuals with different types of payee arrangements (no payee, noninstitutional payee, or clinician payee) were compared on key study variables with the use of bivariate statistics. Second, we used logistic regression to examine demographic and clinical factors associated with experiencing financial leverage, both within the entire sample and within the subset of respondents who had clinician payees. Multivariate logistic regression was used in the analysis of the full sample, whereas zero-order relationships were assessed among the clinician payee subsample, because of the smaller sample size. These analyses were used to identify factors that potentially confound the association between payeeship, financial leverage, and the client-provider relationship.

Third, relationships between clinician payeeship, financial leverage, and the bond and conflict subscales were modeled with hierarchical multiple linear regression. The analysis controlled for clinical and demographic covariates identified in the previous analysis. We entered clinician payeeship on the first step and entered financial leverage on the second step. Testing these models hierarchically permitted us to assess whether financial leverage improved the prediction of bond and conflict the effects of having a clinician as payee and whether financial leverage mediated the relationship between payeeship and the case management relationship ( 35 ).

Results

About half of the sample (107 of 201, or 53%) reported having a payee or money manager; among those with payees, most (84 of 107, or 79%) reported that this individual was a mental health professional. The remainder of respondents with a payee (23 of 107, or 21%) reported that a family member or other informal network member (such as a friend or minister) served in this role. Because our primary focus pertained to differences between clinician payee arrangements and all other arrangements (family or friend payee and no payee), we used bivariate statistical tests (chi square for categorical variables and t tests for continuous variables) to compare respondents with a clinician payee versus all others ( Table 1 ).

Relative to noninstitutional payeeships, clinician payee arrangements were more likely to be assigned through the representative payee program, which often signifies an involuntary arrangement ( 1 ). Compared with other respondents, persons with clinician payees were more often male and were more likely to have co-occurring disorders. They also were rated as having lower functioning, they reported less insight into their mental illness, and they were less likely to complete high school. These results suggest that the participants with clinician payees were more severely impaired than those with no payee or a noninstitutional payee.

About one-fifth (43 respondents) of the 201 respondents reported recent experiences of perceived financial leverage. Of those who did so, most (34 of 43, or 79%) had clinician payees as opposed to no payee or a noninstitutional payee ( χ2 =31.3, df=1, p<.001). In fact, 34 of 84 respondents (40%) who reported having a mental health clinician as their payee reported that they perceived that their money would be withheld if they did not adhere to treatment.

Respondents with clinician payees also scored significantly higher on the conflict dimension of the client-provider relationship, indicating that they were more likely to experience hostile, intrusive, or negative interactions with the case manager. Scores on the bond dimension, however, did not vary significantly between respondents with clinician payees and all other respondents (those with no payee or a noninstitutional payee). Thus the bivariate analyses suggest that in comparison with respondents with no payee or a noninstitutional payee, respondents with clinician payees were more disabled, were more likely to experience perceived financial leverage, and reported higher levels of conflict and negativity in their relationships with their case managers. Subsequent analyses aimed to further clarify the relationships between having a clinician payee, financial leverage, and the client-provider relationship.

First, logistic regression analyses were conducted to identify extraneous variables that increase risk of financial leverage, because these factors might represent potential confounds of the effect of financial leverage on the client-provider relationship. Multivariate analyses of the entire sample of 201 respondents and bivariate analyses of the subsample of 84 respondents with clinician payees are shown in Table 2 . In the full sample, those reporting financial leverage were significantly more likely to be younger than the median age, to have co-occurring psychotic and substance use disorders, and to indicate less insight into their illness (model χ2 =28.5, df=8, p<.001), consistent with analyses across sites reported elsewhere ( 18 ). Within the subsample of respondents with clinician payees, younger age (younger than 45) and greater symptom severity significantly increased the odds of perceived mental health financial leverage. In other words, among individuals at higher risk of financial leverage (such as those whose money is managed by a mental health professional), being younger and having more severe symptoms represented additive risk factors.

|

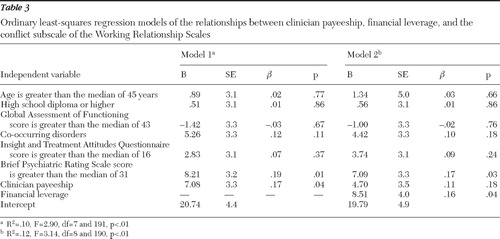

Next, hierarchical multiple regression was used to assess whether having a clinician payee and experiencing financial leverage were associated with differences in the bond and conflict subscales, after analyses controlled for covariates that were identified as risk factors for financial leverage (age, education level, co-occurring disorders, functioning, insight level, and symptom severity). Neither mental health payeeship nor financial leverage was significantly associated with client ratings of the bond dimension of the working relationship (results not shown).

In the model predicting the conflict dimension ( Table 3 ), having a clinician payee, when entered alone, was associated with higher levels of conflict (model 1). When financial leverage was entered in the second step (model 2), however, a different pattern emerged: financial leverage was associated with higher conflict scores, and its addition suppressed the previously significant relationship between clinician payeeship and conflict. This pattern of findings suggests that the difference in conflict scores between individuals with and without clinician payees is explained or mediated by financial leverage, according to the criteria developed by Baron and Kenny ( 35 ). That is, the relationship between the independent variable (clinician payeeship) and the outcome (conflict) was significantly attenuated when the mediator (financial leverage) was taken into account.

|

As more recent guidelines suggest ( 36 ), we conducted a formal test of the significance of this mediating effect. Because the frequency of financial leverage was relatively small, the attenuation of power was a concern, particularly given the number of covariates in the model. To increase the efficiency of the test, we used bootstrap methods to estimate a confidence interval for the mediation effect ( 37 , 38 ). Controlling for clinical and demographic variables (age, education level, co-occurring disorders, functioning, insight level, and symptom severity), we estimated the following regression equations: path a, correlation of the initial variable (clinician payeeship) with the mediator (financial leverage); path b, correlation of the mediator (financial leverage) with the outcome variable (conflict), with controls for the initial variable; and path c, correlation of the initial variable (clinician payeeship) with outcome (conflict). If all three conditions were met, the final step, path c′, was to determine whether the effect of clinician payeeship on conflict was significantly reduced when the mediator (financial leverage) was controlled.

The significance of this mediated effect was tested by computing the product of paths a and b and estimating a 95% confidence interval (CI) with 5,000 bootstrap samples. The estimated mean±SE mediated effect was 2.37±1.33, CI=.16–5.52). Because zero does not lie within the confidence interval, the indirect effect of financial leverage was significantly different from zero at p<.05. Thus the test result suggests that financial leverage mediated the relationship between payeeship and therapeutic relationship conflict.

Discussion

Recent research provides a mixed picture of the effects of representative payeeship, in that studies suggest that it appears to improve functional outcomes but may produce unintended negative consequences, such as interpersonal conflict and even violence directed at payees ( 5 , 8 , 9 , 10 , 11 ). This study explored the hypothesis raised in previous research that payeeship arrangements conducted within mental health treatment contribute to disruption of the client-provider relationship. The study also examined the mediating influence of financial leverage on this relationship.

Clinician payeeship was a common arrangement in this sample, particularly among individuals with substance use disorders and severe mental illness with significant functional impairment and low levels of insight about their illness. As noted in a recent report focusing on all five sites of this study ( 18 ), our site appears to be unusual in the frequency with which these arrangements occur. Financial leverage was more frequently reported by younger and more severely symptomatic respondents, a pattern similar to previous findings that financial leverage and other limit-setting interventions are often used when consumers are seriously impaired or demonstrate adherence problems ( 13 , 15 , 17 , 39 ).

Respondents with clinician payees (relative to those with family or friend payees or no payees) reported more conflict in the case management relationship but had no difference in their bond scores in comparison with the other respondents. This finding suggests that clients with mental health provider payees develop similarly strong attachments to their case managers as those held by their counterparts in other types of money management arrangements; however, they experience more negativity and intrusion in the case management relationship. This finding is consistent with research discussed above that highlights the potential for conflict in clinician payee relationships ( 6 , 11 ), although this study is the first to document this effect from the perspectives of consumers in a mixed sample of clients with and without payees.

We also found, however, that the relationship between clinician payeeship and the therapeutic alliance was explained by its differential association with perceived financial leverage. Thus the analysis suggests that payeeship leads to strain in the therapeutic relationship when it is used as a mechanism for promoting adherence. Previous research has characterized representative payeeship as a treatment mandate because it represents an opportunity context for behavioral leverage ( 40 ). In other words, the legal mechanism of payeeship is not intrinsically coercive but may be used strategically as a source of pressure to use or adhere to treatment. Our finding underscores this distinction. That is, although payeeship grants clinicians the capacity to regulate adherence through the contingent withholding of funds, it is the perception of actually being pressured to adhere in order to access those funds that is linked to disruption in the treatment alliance. In a similar vein, research on the process of psychiatric inpatient admission demonstrates that it is the extent of pressure applied to patients, particularly negative pressures—analogous to financial leverage in the community context—that most strongly determines the level of perceived coercion ( 41 , 42 , 43 ).

The potential threat that financial leverage poses to the case management relationship should not be taken lightly, given that the alliance appears to play a pivotal role in the engagement, retention, and successful treatment of clients in mental health services ( 44 , 45 ). Furthermore, consumer surveys suggest that relationships with providers are among the most valued aspects of treatment, and many consumers view these relationships as central to the recovery process ( 46 , 47 , 48 , 49 ). As other recent work reports, consumers report fairly high levels of satisfaction with certain aspects of payeeship services, such as budgeting assistance, when they are offered within the clinical setting ( 6 , 50 ). Taken together, these findings suggest that a therapeutically optimal way to use payeeship may be to focus on building skills for eventual financial independence rather than using the mechanism as leverage to promote adherence. On the other hand, it is possible that using financial leverage in a collaborative contingency management contract would be perceived by consumers as less intrusive than financial leverage administered in an ad hoc manner ( 2 , 51 , 52 ). Examining such contextual effects could be a fruitful avenue for future study.

This study has several methodological limitations. Because perceived financial leverage was measured from the client perspective, this inquiry cannot determine whether it actually happened. It is possible, for example, that consumers who perceive conflict with their case managers might overreport experiences of financial leverage, which would therefore overestimate the relationship between the two. As noted elsewhere ( 53 , 54 ), measuring treatment pressures via client self-report is a common limitation in much of the extant research on coercion, yet alternative methods are both impractical and costly. In the only existing study to triangulate perspectives on treatment pressures, Lidz and colleagues ( 54 ) found that consumer self-report, though imperfect, correlated more highly with an observer-rated criterion measure than did the self-reports of professionals. In light of the limited alternatives available, relying on consumer reports of financial leverage is thus a reasonable strategy. Nonetheless, further study using clinician reports or independent observation of leverage is warranted.

Because money management characteristics were not manipulated experimentally, we cannot rule out the possibility that unobserved factors not controlled for in our models account for the relationship between perceived financial leverage and the client-rated conflict subscale. For example, we lacked information on whether payeeship was involuntary, which was predictive of a weaker alliance in a previous study of clients with representative payees ( 12 ). Because the data reported here are cross-sectional, this study likewise cannot establish the direction of the observed relationships. Finally, we note that the setting studied is unusual in that the clinic offered a large-scale money management program; however, there is wide variation in the availability and use of such institutional payeeship arrangements ( 18 ). Thus the findings may be less applicable to settings in which payeeship functions are performed primarily by family members, attorneys, or social service providers.

Conclusions

This study linked use of financial leverage within professional payee services with higher levels of conflict and negativity within the treatment alliance and showed that this link accounts for the elevated levels of negative interactions between consumers and clinician payees. Although payeeship serves important supportive functions and may enhance functional outcomes, decisions about whether to use it as a source of treatment leverage should take into account potential disruption to the therapeutic alliance.

Acknowledgments and disclosures

This research was supported by the MacArthur Research Network on Mandated Community Treatment. The authors thank Amy Mericle, Ph.D., and Fred Markowitz, Ph.D., for statistical consultation; Krisha Martinez, A.M., for assistance with data collection and management; and John Monahan, Ph.D., for feedback on a draft of this article.

The authors report no competing interests.

1. Luchins DJ, Roberts DL, Hanrahan P: Representative payeeship and mental illness: a review. Administration and Policy in Mental Health 30:341–353, 2003Google Scholar

2. Rosen MI, Bailey M, Rosenheck RA: Principles of money management as a therapy for addiction. Psychiatric Services 54:171–173, 2003Google Scholar

3. Luchins DJ, Hanrahan P, Conrad KJ, et al: An agency-based representative payee program and improved community tenure of persons with mental illness. Psychiatric Services 49:1218–1222, 1998Google Scholar

4. Rosen MI, Rosenheck RA: Substance use and assignment of representative payees. Psychiatric Services 50:95–98, 1999Google Scholar

5. Rosenheck RR, Lam J, Randolph F: Impact of representative payees on substance use among homeless persons diagnosed with serious mental illness and substance abuse. Psychiatric Services 48:800–806, 1997Google Scholar

6. Dixon L, Turner J, Krauss N, et al: Case managers' and clients' perspectives on a representative payee program. Psychiatric Services 50:781–786, 1999Google Scholar

7. Conrad KJ, Lutz G, Matters MD, et al: Randomized trial of psychiatric care with representative payeeship for persons with serious mental illness. Psychiatric Services 57:197–204, 2006Google Scholar

8. Elbogen E, Swanson JW, Swartz MS: Effects of legal mechanisms on perceived coercion and treatment adherence among persons with severe mental illness. Journal of Nervous and Mental Disease 191:629–637, 2003Google Scholar

9. Elbogen E, Swanson J, Swartz M, et al: Family representative payeeship and violence risk in severe mental illness. Law and Human Behavior 29:563–573, 2005Google Scholar

10. Brotman AW, Muller JJ: The therapist as representative payee. Hospital and Community Psychiatry 41:167–171, 1990Google Scholar

11. Conrad KJ, Matters MD, Hanrahan P, et al: Representative payee for individuals with severe mental illness at Community Counseling Centers of Chicago. Alcoholism Treatment Quarterly 17:169–186, 1999Google Scholar

12. Rosen MI, Desai R, Bailey M, et al: Consumer experience with payeeship provided by a community mental health center. Psychiatric Rehabilitation Journal 25:190–195, 2001Google Scholar

13. Monahan J, Redlich AD, Swanson JW, et al: Use of leverage to improve adherence to psychiatric treatment in the community. Psychiatric Services 56:37–44, 2005Google Scholar

14. Hanrahan P, Luchins DJ, Savage C, et al: Representative payeeship programs for persons with mental illness in Illinois. Psychiatric Services 53:190–194, 2002Google Scholar

15. Elbogen E, Swanson J, Swartz M: Psychiatric disability, the use of financial leverage, and perceived coercion in mental health services. International Journal of Forensic Mental Health 2:119–127, 2003Google Scholar

16. Angell B, Mahoney CA, Martinez NI: Promoting treatment adherence in assertive community treatment. Social Service Review 80:485–526, 2006Google Scholar

17. Neale MS, Rosenheck RA: Therapeutic limit setting in an assertive community treatment program. Psychiatric Services 51:499–505, 2000Google Scholar

18. Appelbaum PS, Redlich A: Use of leverage over patients' money to promote adherence to psychiatric treatment. Journal of Nervous and Mental Disease 194:294–302, 2006Google Scholar

19. Elbogen E, Soriano C, Van Dorn R, et al: Consumer perspectives on representative payee use of disability funds to leverage treatment adherence. Psychiatric Services 56:45–49, 2005Google Scholar

20. Yamaguchi JL: Measuring the Consumer-Case Worker Relationship in Assertive Community Treatment (ACT). Doctoral dissertation. Chicago, University of Chicago, School of Social Service Administration, 1999Google Scholar

21. Calsyn RJ, Morse GA, Klinkenberg WD, et al: Client outcomes and the working alliance in assertive community treatment programs. Care Management Journals 5:199–202, 2006Google Scholar

22. Finaret AE, Shor R: Rehabilitation relationships with persons with mental illness and the dilemmas and conflicts which characterize these relationships. Qualitative Social Work 5:151–156, 2006Google Scholar

23. Coffey DS: Connection and autonomy in the case management relationship. Psychiatric Rehabilitation Journal 26:404–412, 2003Google Scholar

24. Gibbons C, Bedard M, Mack G: A comparison of client and mental health worker assessment of needs and unmet needs. Journal of Behavioral Health Services and Research 32:95–104, 2005Google Scholar

25. Horvath AO, Bedi RP: The alliance, in Psychotherapy Relationships That Work: Therapist Contributions and Responsiveness to Patients. Edited by Norcross JC. New York, Oxford University Press, 2002Google Scholar

26. Jöreskog K, Sörbom M: LISREL 8.7. Chicago: Scientific Software, 2000Google Scholar

27. Bollen KA: Structural Equations With Latent Variables. New York, Wiley, 1989Google Scholar

28. Bachelor A, Salame R: Participants perceptions of the dimensions of the therapeutic alliance over the course of therapy. Journal of Psychotherapy Practice and Research 9:39–52, 2000Google Scholar

29. Wright BD, Masters GN: Rating Scale Analysis. Chicago: MESA Press, 1982Google Scholar

30. Linacre JM: Winsteps Rasch Analysis Software, version 3.58.1. Chicago, Winsteps, 2005Google Scholar

31. Rosen MI, Rosenheck RA, Shaner AL, et al: Substance abuse and the need for money management assistance among psychiatric inpatients. Drug and Alcohol Dependence 67:331–334, 2002Google Scholar

32. Woerner MG, Mannuzza S, Kane JM: Anchoring the BPRS: an aid to improved reliability. Psychopharmacology Bulletin 24:112–117, 1988Google Scholar

33. Endicott J, Spitzer RL, Fleiss JL: The Global Assessment Scale: a procedure for measuring the overall severity of psychiatric disturbance. Archives of General Psychiatry 33:766–771, 1976Google Scholar

34. McEvoy J, Apperson LJ, Appelbaum P, et al: Insight into schizophrenia: its relationship to acute psychopathology. Journal of Nervous and Mental Disease 177:43–47, 1989Google Scholar

35. Baron RM, Kenny DA: The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology 51:1173–1182, 1986Google Scholar

36. MacKinnon DP, Lockwood CM, Hoffman JM, et al: A comparison of methods to test the significance of mediation and other intervening variable effects. Psychological Methods 7:83–104, 2002Google Scholar

37. Shrout PE, Bolger N: Mediation in experimental and nonexperimental studies: new procedures and recommendations. Psychological Methods 7:422–445, 2002Google Scholar

38. MacKinnon DP, Lockwood CM, Williams J: Confidence limits for the indirect effect: distribution of the product and resampling methods. Multivariate Behavioral Research 39:99–128, 2004Google Scholar

39. Angell B: Measuring adherence strategies used by providers to encourage medication adherence. Journal of Behavioral Health Services and Research 33:53–72, 2006Google Scholar

40. Monahan J, Bonnie RJ, Appelbaum PS, et al: Mandated community treatment: beyond outpatient commitment. Psychiatric Services 52:1198–1205, 2001Google Scholar

41. Lidz CW, Mulvey EP, Hoge SK, et al: Factual sources of psychiatric patients' perceptions of coercion in the hospital admission process. American Journal of Psychiatry 155:1254–1260, 1998Google Scholar

42. Lidz CW, Hoge SK, Gardner W, et al: Perceived coercion in mental hospital admission: pressures and process. Archives of General Psychiatry 52:1034–1039, 1995Google Scholar

43. Cascardi M, Poythress NG: Correlates of perceived coercion during psychiatric hospital admission. International Journal of Law and Psychiatry 20:445–458, 1997Google Scholar

44. Martin DJ, Garske JP, Davis MK: Relation of the therapeutic alliance with outcome and other variables: a meta-analytic review. Journal of Consulting and Clinical Psychology 68:438–450, 2000Google Scholar

45. Howgego IM, Yellowlees P, Owen C, et al: The therapeutic alliance: the key to effective patient outcome? A descriptive review of the evidence in community mental health case management. Australian and New Zealand Journal of Psychiatry 37:169–183, 2003Google Scholar

46. Mancini MA, Hardiman ER, Lawson H: Making sense of it all: consumer providers' theories about factors facilitating and impeding recovery from psychiatric disabilities. Psychiatric Rehabilitation Journal 29:48–55, 2005Google Scholar

47. McGrew JH, Wilson, RG, Bond GR: Client perspectives on helpful ingredients of assertive community treatment. Psychiatric Rehabilitation Journal 19:13–21, 1996Google Scholar

48. Van Weeghel J, Van Audenhove C, Colucci M, et al: The components of good community care for people with severe mental illness: views of stakeholders in five European countries. Psychiatric Rehabilitation Journal 28:274–281, 2005Google Scholar

49. Scheyett A, McCarthy E., Rausch C: Consumer and family views on evidence-based practices and adult mental health services. Community Mental Health Journal 42:243–257, 2006Google Scholar

50. Rosen MI, Bailey M, Dombrowski E, et al: A comparison of satisfaction with clinician, family members/friends and attorneys as payees. Community Mental Health Journal 41:291–306, 2005Google Scholar

51. Heinssen RK, Levendusky PG, Hunter RH: Client as colleague: therapeutic contracting with the seriously mentally ill. American Psychologist 50:522–532, 1995Google Scholar

52. Bonnie R, Monahan J: From coercion to contract: reframing the debate on mandated community treatment for people with mental disorders. Law and Human Behavior 29:485–503, 2005Google Scholar

53. Lidz CW, Mulvey EP, Hoge SK, et al: Sources of coercive behaviours in psychiatric admissions. Acta Psychiatrica Scandinavica 101:73–79, 2000Google Scholar

54. Lidz CW, Mulvey EP, Hoge SK, et al: The validity of mental patients' accounts of coercion-related behaviors in the hospital admissions process. Law and Human Behavior 21:361–376, 1997Google Scholar